#### Update 29/07/11 – VMware is making changes the initial vRAM licensing allocations for vSphere 5 ####

Summary of changes are:

- VMware vSphere 5 Essentials will give a 24GB vRAM entitlement

- VMware vSphere 5 Essentials Plus will give a 32GB vRAM entitlement

- Max vRAM in Essentials / Essentials Plus will be maxed at 192GB vRAM

- VMware vSphere 5 Standard vRAM entitlement has changed to 32GB (assumption)

- VMware vSphere 5 Enterprise vRAM entitlement will be doubled to 64GB

- VMware vSphere 5 Enterprise Plus vRAM entitlement will be doubled to 96GB

And – interesting for users targeting to utilize the recently announced (up to) 1TB vm capability – The amount of vRAM that counts against the overall vRAM license pool will be capped to 96GB per VM. That means, even if you assign e.g. 1TB of RAM to a VM, it will only take away 96GB of RAM from your license entitlement!

Now, this is certainly looking much better!

Cynics might say that ‘the damage has been done’, the ‘sleeping dogs have been woken’. However, this change would certainly calm the nerves of many folks who projected their memory growth over the next years and realised the long-term impact of the initial vRAM licensing structure.

#### Update End ####

If I had to sum it up … Great Products, Questionable Communication Strategy and Dangerous Timing.

Before going any further – I actually think it’s a shame that the licensing change and the subsequent online “riot” overshadowed the excellent new features announced yesterday and yes, I am painfully aware that by writing this article I am fostering that very pattern …

However (while having great and honest respect for VMware) I’ve also always been very open about my attitude towards customer choice and healthy competition in this space … so here it goes …

Dangerous timing

Let me put it simple … had VMware done this only 2 years ago I would have said “ok, that’s the luxury a market leader has, that’s the way business works”… .

There is no doubt that VMware still is the market leader BUT many customers have now “good-enough” alternatives…

It is not that customers didn’t want to look at alternatives 3 or 4 years ago, no, they actually did and said “it’s not good enough – it does not what we need it to do” …

… But 2011? This year it’s all coming to a head!

- Microsoft closed the (initially massive) gap with the announcement of SCVMM 2012 – directly trying to match vCenter features and squaring up to vCloud Director. (yes, it’s only a beta at the moment)

- Citrix just announced the beta of XenServer 6 and also the acquisition of cloud.com the very same day VMware announced vSphere 5 and vCloud Director 1.5, demonstrating how serious they are to compete in this space.

- Red Hat has announced their CloudForms cloud platform and pushes KVM through alliances like OVA as open source alternative to VMWare. Big names like Intel, IBM and HP are in this too. A beta of RHEV 3 is expected soon and promising to be a very competitive release.

- Gartner has just added Microsoft and Citrix to the leader quadrant of it’s Magic Quadrant for Server Virtualization 2012 – as sign of the time!

There is no doubt that VMware still IS the market leader BUT many customers will have “good-enough” alternatives by the end of this year.

The biggest mistake VMware can make is to erode it’s strongest pillar – todays small, medium and large Enterprise virtualization customer and sacrifice this for an (arguably strategic but unvalidated) cloud market …

The biggest mistake VMware can make is to erode it’s strongest pillar – today’s cost-concious small, medium and large Enterprise virtualization customer and sacrifice this for an (arguably strategic but unvalidated) cloud market.

Yes VMware has the most comprehensive and advanced feature set but customer will look for (and I use the term again) GOOD-ENOUGH alternatives. Yes Storage DRS, auto-deploy and 1TB vms are sophisticated technologies but are they a requirement for the majority of today’s virtualization customer, something they really can’t do without?

More importantly, will everyone look today at vCloud Director, SRM and vShield and accept the value they provide as today’s strategic “must-have” – that’ s a key question here!

Exposing this pillar and opening up the door for Microsoft, Citrix and Red Hat to even just provide the “lower architectural layers” (e.g. hypervisor and base vm management) would be extremely dangerous!“Hypervisor and vm management” – The importance of this control point has often been greatly underestimated and is in reality exactly what VMware’s stronghold is …

The importance of this control point has often been greatly underestimated and is in reality exactly what VMware’s stronghold is. Today it’s often belittled as “commodity” in the shadow of “cloud” discussions – but without it VMware would not dominate the Enterprise virtualization market. And without its dominance in the Enterprise virtualization VMware have little leverage to enter the wider cloud market as it’s strategy is primarily based on expanding from virtual infrastructure to cloud through a service provider/hybrid approach.

So IMHO the timing for this change could not have been worse – will Microsoft& Co be scared by the latest technology leap or see this announcement as an opportunity … time will tell …

So what happened?

The Good

VMware announced their next generation “Cloud Infrastructure Suite” with vSphere 5, SRM 5, vCloud Director 1.5 and vShield 5 (click links for the respective – good – “what’s new” flyers).

The feature sets of vSphere 5 are impressive and VMware has in many respects extended it’s lead as visionary and executioner in the virtualization space …

The feature sets are impressive to say the least and VMware has in many respects extended it’s lead as visionary and executioner in the virtualization and (to some extend) cloud space. There is already a wealth of information on the new features available – so I have only attached a few “recommended links” at the bottom of this post.

The Bad (?)

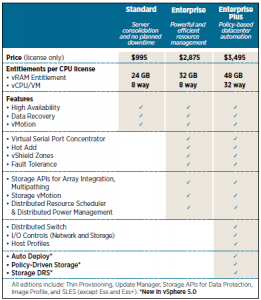

With that they also announced a change in licensing for vSphere 5 – adding a memory-based charging model to the existing “per CPU” license. In simplified terms, memory usage will be “capped” to 24, 32 and 48GB per (old CPU socket) license, so exceeding these memory to CPU ratios means you have to buy additional licenses with vSphere 5.

How Bad?

In reality the implications of this will depend on your specific environment, mainly your current “memory to CPU ratio”, your consolidation ratio and your existing license levels.

To get a quick indication, calculate your current “memory” to CPU” ratio and see if this exceeds these capping levels listed above. (Bear in mind that it is the total configured amount for your vms, so if you are currently heavily over-subscribing memory then you might have an unpleasant surprise).

But it transpires that for a good chunk of actual customers reality will be less rosy. Read some of the comments at the bottom of Gabe’s post (good post – dubious title) to see some interesting real life examples.

If you are using Enterprise Plus only to run your 12 core AMD CPUs then you are in luck!

If you are attempting to run those “monster vms” announced with vSphere 5 – think twice!

Two extreme examples:

- If you are using Enterprise Plus only to run your 12 core AMD CPUs then you are in luck (as long as your memory ratio is below the capping levels). Switch to any suitable lower edition and save the price difference.

- On the other hand, if you are attempting to run one of those “monster vms” announced with vSphere 5 – think twice! A single 1TB virtual machine can cost you $76,890 in vSphere licensing fees (22 Enterprise Plus licenses).

Now you can question my sanity based on how many systems out there are actually using 1TB and how much that physical system would be – but then I’d have to question the announcement to support 1TB vms in general and more importantly the ill-considered timing of announcing these two together – as one basically negates the other!

Yes, change “always hurts” and an initial adverse reaction to change is not necessarily an indication that the change is wrong/bad. In reality most will sit somewhere in between those two use cases, more real-life analysis is needed to fully understand the impact and it is important not to fall into the trap of competitive exploration.

Communication

Yes, there was only some disclosure to analysts and selected customers (I had actually a client asking me months ago on my opinion about vRAM charging – long before I was disclosed).

We all know why VMware changed licensing – the fact that customers scaled their environments by buying CPUs from Intel/AMD – rather than buying VMware licenses …

But I believe much more could have been done to prepare the community and also that a lot of the uproar was caused by the somewhat patronising way VMware positioned the change as “simplification of licensing”. Now, the VMware user community is arguably comprised of the most switched-on individuals out there … we all understand why VMware is ultimately doing this. The fact that customers scaled their environments by buying new CPUs with more cores – rather than buying VMware licenses – must have driven VMware mad.

In initial discussion with a client I was asked how VMware can seriously position this as “simplification, fairness and flexibility” (words from the licensing guide).

“Simplification and ability to project costs? Now I don’t even know what my licensing will be based on, it could be memory or CPU …? Flexibility – configured vm memory – what happened to my flexibility of oversubscribing memory? Pooled licensing – well, to be honest we had that since the introduction of a license server.

…visionary licensing – well possibly but to be honest I’m not even using charge-back internally and “cloud” is literally a vison for me – not todays reality, today’s reality is keeping cost down … . “

So yes, it is fairer to VMware (if there is such a thing in business) a “loop-hole” created by hardware evolution has been closed – if customers with existing subscriptions however feel the same remains to be seen …

Any hardware vendor with scale-up systems and memory extending capabilities will feel the pain – and will be open to offer alternatives.

Many OEM Vendors and Service Providers won’t be happy

Another important part has not been widely considered – the OEM hardware partners shifting a massive share of VMware’s licenses …

Now – being with IBM – I can’t and won’t comment officially here at all but it will be clear to everyone that this licensing announcement has an impact on the hardware platform. Vendors have advocated the value of scale-up approaches in accounts for a long time. Any vendor with scale-up systems and memory extending capabilities will feel the pain. Any customer who has invested in such a strategy will go back to the drawing board and review – now I’m not saying that scale-up and memory extensions are “dead in the water” at all – I’m actually convinced that for many customers it will remain to be an efficient approach – but some of the value proposition has clearly taken a knock (that is of course … if you deploy with vSphere – … back to the point …).

It will also come as no surprise that those systems are typically the ones with the largest profit margins – so vendors will care!

An even more important segment will be the service provider community – which VMware will need on their side to make vCloud a success – I am curious to see what charging models VMware will come up with to keep them happy!

All that brings us to the most important point of all of this – where will this lead the VMware customer base – or … where will they be lead to …?

Recommended Reads:

- Chad Sakac’s summary of announcements with great sub-posts on individual topics

- What’s news in vCloud Director 1.5 – really good, easy to read summary of new features

- vSphere-land’s links to vSphere 5 – great collection of links by category

The VirtualizationMatrix will be updated as soon as the vSphere 5 code is available for download

### Archived Article – thanks to Andreas Groth – WhatMatrix Community Affiliate (originally published on Virtualizationmatrix.com) ###

Latest posts by Community Author (see all)

- WhatMatrix Q&A with Citrix– Virtual Desktop, DaaS, VDI and WVD - July 5, 2020

- We hope you are well – help for vendors – free lead generation - March 27, 2020

- Landscape Report Guidance: Cloud Management Platforms - February 5, 2020